Little Known Facts About Small Business Accountant Vancouver.

Wiki Article

Some Ideas on Cfo Company Vancouver You Need To Know

Table of ContentsThe Definitive Guide for Small Business Accountant Vancouver3 Easy Facts About Virtual Cfo In Vancouver Shown4 Easy Facts About Cfo Company Vancouver DescribedSmall Business Accounting Service In Vancouver for Dummies

That takes place for each single deal you make throughout a given accounting period. Your audit period can be a month, a quarter, or a year. It all boils down to what works best for your company. Dealing with an accounting professional can aid you discuss those information to make the bookkeeping procedure benefit you.

What do you finish with those numbers? You make modifications to the journal entrances to see to it all the numbers accumulate. That could consist of making modifications to numbers or managing built up products, which are expenditures or earnings that you sustain but do not yet spend for. That obtains you to the changed trial equilibrium where all the numbers build up.

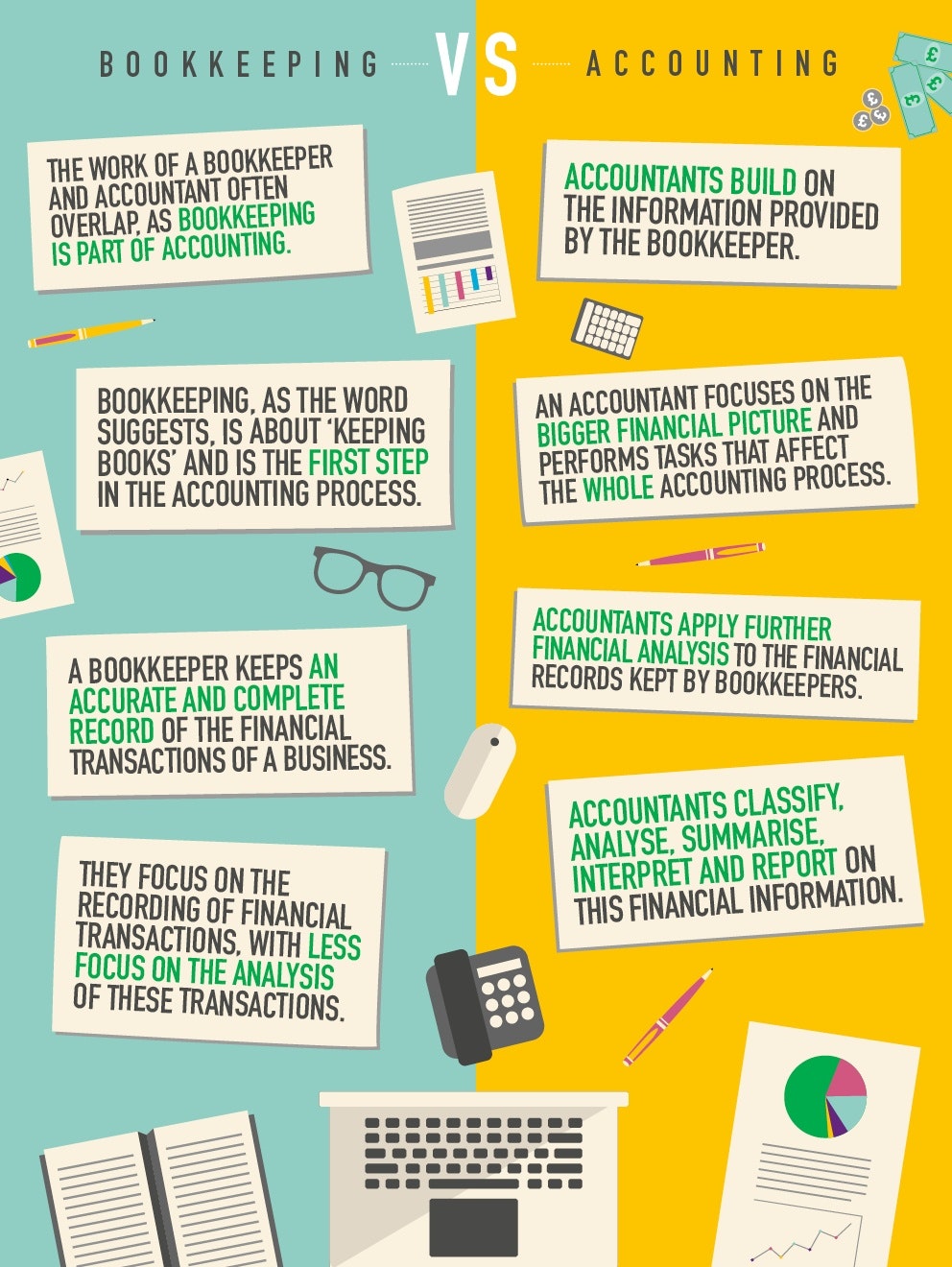

Bookkeepers as well as accounting professionals take the very same fundamental accountancy programs. This guide will certainly give an in-depth breakdown of what separates bookkeepers from accountants, so you can understand which bookkeeping function is the finest fit for your profession ambitions currently and in the future.

About Vancouver Tax Accounting Company

An accounting professional constructs on the information offered to them by the bookkeeper. Usually, they'll: Review monetary declarations prepared by an accountant. Analyze, analyze or testify to this information. Transform the information (or documents) right into a report. Share recommendations as well as make referrals based on what they have actually reported. The documents reported by the bookkeeper will establish the accountant's advice to management, and also eventually, the health and wellness of business overall.e., government companies, universities, health centers, etc). An educated as well as competent accountant with years of experience as well as first-hand understanding of accounting applications ismost likelymore certified to run the publications for your organization than a recent bookkeeping major grad. Maintain this in mind when filtering applications; try not to evaluate applicants based upon their education and learning alone.

Company projections and also patterns are based on your historic financial data. The financial information is most dependable and exact when given with a durable and also organized accounting procedure.

Some Known Details About Small Business Accountant Vancouver

Bookkeeping, in the typical sense, has been about as long as there has actually been commerce because around 2600 B.C. An accountant's job is to keep full documents of all cash that has actually entered into and headed out of the service - Pivot Advantage Accounting and Advisory Inc. in Vancouver. Bookkeepers record daily purchases in a consistent, easy-to-read means. Their documents allow accountants to do their work.Usually, an accounting professional or owner oversees an accountant's work. An accountant is not an accountant, nor need to they be considered an accountant. Bookkeepers record economic purchases, post debits as well as credit histories, develop invoices, take care of pay-roll and also preserve and stabilize the publications. Bookkeepers aren't required to be licensed to take care of the books for their clients or employer however licensing is Full Report offered.

Three major variables affect your costs: the services you desire, the competence you require and also your local market. The accounting solutions your organization needs and also the amount of time it takes regular or monthly to finish them influence just how much it sets you back to hire an accountant. If you need a person ahead to the workplace as soon as a month to integrate guides, it will set you back much less than if you need to hire a person full time to manage your everyday operations.

Based on that estimation, determine if you need to hire somebody full-time, part-time or on a project basis. If you have complicated publications or are generating a whole lot of sales, hire a certified click this or certified bookkeeper. A knowledgeable bookkeeper can offer you tranquility of mind and also confidence that your financial resources remain in great hands but they will also cost you much more.

All About Small Business Accounting Service In Vancouver

If you live in a high-wage state like New York, you'll pay more for an accountant than you would in South Dakota. According to the Bureau of Labor Statistics (BLS), the national typical wage for accountants in 2021 was $45,560 or $21. 90 per hr. There are several benefits to working with a bookkeeper to file and document your company's monetary records.

They may pursue extra accreditations, such as the Certified public accountant. Accounting professionals might likewise hold the placement of bookkeeper. Nonetheless, if your accounting professional does your accounting, you might be paying greater than you should for this service as you would generally pay more per hr for an accounting professional than an accountant.

To complete the program, accountants need to have four years of appropriate job experience. The factor below is that hiring a CFA indicates bringing highly innovative accountancy understanding to your company.

To get this accreditation, an accountant must pass the called for look at this now tests as well as have two years of professional experience. You might work with a CIA if you desire an extra customized emphasis on monetary danger evaluation as well as safety tracking procedures.

Report this wiki page